Non Americans are almost all familiar with scenes of people striking it rich in real estate in the United States. People speculate, flip, use credit, become rich and then sometimes lose it all. It’s a vast and attractive market, not just for the potential returns, but also because of the perceived safety of having a house or a condo in the United States. That being said, there are a few surprises awaiting the non-resident foreigner wanting to make a real estate investment in the United States.

Many have made money, especially if they bought at the right time. However the market in America is unique in many regards. It is important to understand the nuances of investing in the United States, as the market is in many ways very different from your home market. And if you get these points below wrong, it can dramatically impact your returns.

Learning #1: The way you set up your purchase is crucial, and requires preparatory work

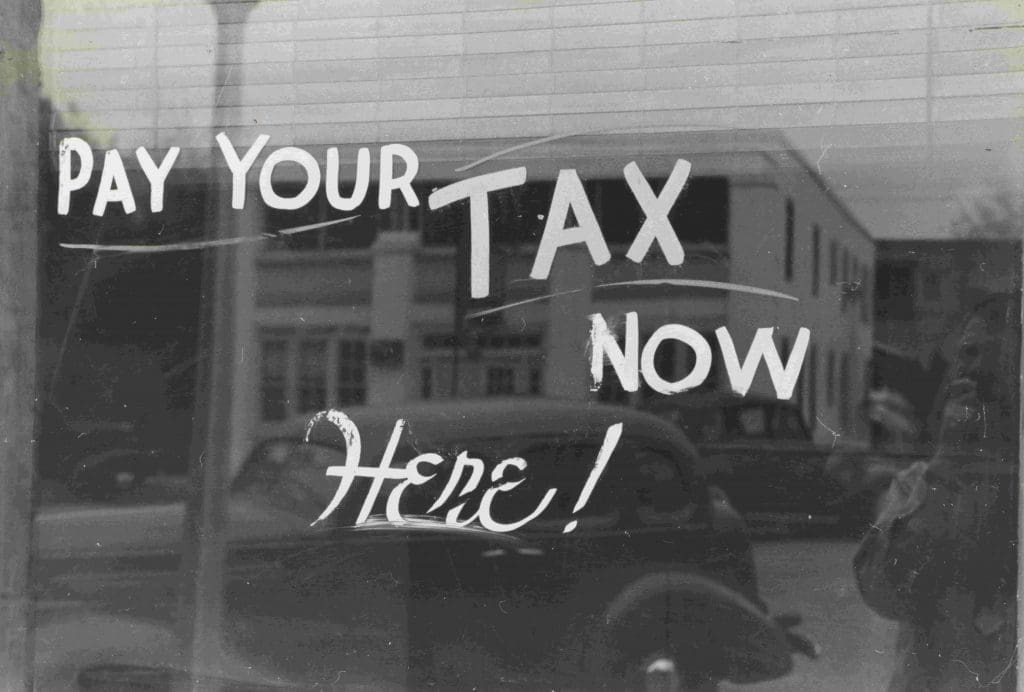

Many foreigners make the mistake of going to the United States and simply purchasing a property in their own name as it’s logical, easy and quick. However, if you qualify as a non-resident alien according to the IRS, then you are liable to pay a 30% withholding tax on your gross rental income, without any deductions allowed. Needless to say, you end up with a terrible yield.

The way to avoid this is to create a local LLC, and purchase the property through that entity.

Again, this topic is a minefield, and it is crucial that you do proper research based on your particular situation. For example, if you want to minimize estate taxes, the best way is to buy through a foreign corporation, but there again you’ll get slapped with the withholding tax.

My main point is that it is not straightforward, as there are many ways to structure your purchase. You must carefully analyse which structure is best for your particular situation before going to the United States to make your property purchase, as you may have to do some paperwork to have your LLC ready in time. Do not rely on your agent’s advice as often Americans are not familiar with the tax implications for non-resident aliens.

As for creating the LLC, get in touch with a lawyer, or just use templates and create it yourself online if you want to save money. It’s surprisingly easy to do. Just beware as it’s obviously riskier to operate this way.

Learning #2: Americans are less emotional about housing

In Europe, selling your house is a pretty emotional decision. People typically keep them for many years, and often across generations. In the United States, people will sell their house in a heartbeat because they found a new job somewhere else. It also means that a house which might look fine for a European, might just be “old” for an American, and will thus see its value depreciate quicker than you would expect. Same thing with condos; many Europeans make the mistake of going to Miami, and buying a condo in some building from the 70s. For the European it looks fine but for an American it’s just an old condo that he might live in because he has to, but not because he wants to.

Similarly, beware of buying a “McMansion”, these massive houses in the suburbs, that the boomer generation was so keen on. Millenials are not interested in, and don’t have the money for, massive houses with 6 ensuite-bedrooms. Boomers are dying & downgrading, and millennials are less interested.

As a non-American, it’s important to understand these cultural dynamics for your investment.

In a nutshell, housing depreciates faster in America than in Europe.

Learning #3: Beware, you could very well get sued over something trivial

Americans love to sue. They’ll sue you for anything. An oft repeated statistic is that about a third of businesses get sued in any given year. Your tenant might slip in the staircase, and somehow feel it’s your fault and sue you. For non Americans this type of attitude and behavior is completely incomprehensible, but it’s the reality. Americans are a generally reasonable people, but NOT when it comes to the law.

So what must you do? Get liability insurance, and preferably buy through a company to protect your other assets

Learning #4: Choose your investment destination very carefully; politics matter

A great thing about America is the vastness of its territory. It is not just one market, but many different markets. At any given time you’ll have local property markets that are booming, whilst others are crumbling. There is always a place to make money if you look hard enough and follow trends carefully.

That said, you should take into account the local regulations and taxes. California and New York will tax you very heavily, and have complicated regulations, whilst other states such as Texas won’t even have a state income tax, and will make kicking out delinquent tenants very easy. Some states have estate (death) taxes and others don’t.

Think of America as different countries with their own tax laws and regulations. Just as you don’t invest in “Europe”, you don’t just invest in “America” but in a chosen state.

Learning #5: Beware of property taxes and Home Owners Association dues when calculating your yield

You might come from a country where property taxes are an after thought, or at most the equivalent of a month of rental income. In the United States it’s not uncommon to be paying the equivalent of 3-4 months of rental income in property taxes. Particularly in states with no state income tax, property taxes are the preferred way to raise money for school districts and the like. Home owners associations dues can also add up, and vary massively from one area to the next. If your house is in a beautiful community with white picket fences, perfectly manicured gardens, overly friendly retired boomers with great teeth, and an eager private security officer, then beware of yield depressing HOA dues.

America is incredibly diverse, and you can choose to invest in line with your philosophy. States vary massively, even counties within states differ, and within these counties home owners associations can be very different. Similar houses two streets from each other might have extremely dissimilar metrics due to property taxes and HOA dues. So do your research properly – never just assume.

Learning #6: Choose your school district carefully

America is not Finland where probably 95% of schools are great. If your house is in what is reputed to be a bad school district, then your capital appreciation will have a leash pulling it back, and finding good tenants will be harder. Again, do your research beforehand to understand the school districts in the area where you want to invest, or else you might end up being flogged a property which will then surprise you in a bad way later.

Learning #7: Housing in the United States is very data driven

The United States has the Multiple Listing Service, the MLS. On any given house for sale you’ll have all the information you needs such a size, past transaction prices and owners, school district, HOA, property taxes, etc. For example, in Durham, North Carolina, now 11% of property transactions are done by “ibuyers”. Yes, it means algorithms are buying and selling individual houses, which is completely unheard of in most of the rest of the world.

It means that you must pay attention to the data when purchasing, and the use of an Excel spreadsheet to compare your options is key, even more so than in other markets. This level of transparency also makes it harder to find a great deal as a foreigner, as locals are on it very quickly. So buy in a market where the fundamentals are good, and grow along with the market.

Learning #8: Contact the title company beforehand. Sometimes making a real estate investment in the United States as a non-resident foreigner is not straightforward

Some transfer agents will not accept a normal wire from abroad, and require the funds to transit through an American account first. Don’t get me started on why; it’s just a fact. Make sure to contact them beforehand to be prepared.

Learning #9: Be ready for the IRS to keep a lot of your money when you sell

The “Foreign Investment in Real Property Tax Act of 1980” (FIRPTA) rarely gets discussed online. Surprise – it is not your friend. Read here and here.

The main stipulation is that if you sell a property in the United States as a non resident alien, the IRS will keep 15% (!) of the sales price until you fill out your income tax declaration and pay your capital gains taxes. This process can take months, even years, as the IRS is incredibly inefficient. It’s impossible to give a proper timeline, so make sure you don’t depend on that 15%. There are some exemptions, such as when the property you sell is for less than $300,000 and the buyers will use it as their residence, not as an investment property. You’ll need a good CPA that understands the taxation of non resident aliens to properly fill out the yearly income tax declaration which you will have to do to. Don’t even think of doing it on your own; taxes in America are complicated.

Learning #10: Choose your bank wisely

Many American banks are not used to non resident aliens, and even though opening the account might be easy if you have the proper paperwork, maintaining it functional is another matter. Some banks will insist on a US sim card. Others will not want to send your debit card to an overseas address upon renewal, and yet others will not accept online international transfers, thus requiring you to go to the branch in person.

My best advice is to go to a mid-sized regional bank as they are often more flexible than the major banks. Set up an appointment at their headquarters branch, meet the branch manager, explain your situation & needs, and ask to see compliance as well to ensure everyone is aligned. In line with this approach, make sure you have a dedicated account manager, rather than having to go through an anonymous call center in case of issues.

Should you make a real estate investment in the United States as a non-resident foreigner?

Overall, investing in real estate in the United States as a non resident foreigner can be very attractive if you choose your investment carefully. Just bear in mind that the market is very different from your home market in many respects, and invest accordingly. In my experience, the most pleasant part of investing in America is the quality of the support you can find. In many countries it’s almost impossible to find a good, reliable property manager. However in the US, you find people who are competent, helpful, kind, and without any of the nonsense and lies that are common in many parts of the world.

You can also watch the Youtube version of this content if you are interested.

If you want to read more such articles on other real estate markets in the world, go to the bottom of my International Real Estate Services page.

Subscribe to the PRIVATE LIST below to not miss out on future investment posts, and follow me on Instagram, X, LinkedIn, Telegram, Youtube, Facebook, and Rumble.

My favourite brokerage to invest in international stocks is IB. To find out more about this low-fee option with access to plenty of markets, click here.

If you want to discuss your internationalization and diversification plans, book a consulting session or send me an email.

Good points here! It seems to me though that there are more options regarding point #1: you can buy a property in your own name and choose the special election under 871(d) to be treated as a business, and you can do deductions. Or am I missing something?

Source: https://www.irs.gov/individuals/international-taxpayers/nonresident-aliens-real-property-located-in-the-us

Thanks for sharing Matt. Honestly, I don’t know. BUT, even if it were an option I would not opt for this due to the lack of limited liability. One of the biggest risks in America is getting sued. Landlords get sued a lot.