Secure Gold & Silver Storage in Singapore: Silver Bullion’s S.T.A.R. Vaults

In partnership with Silver Bullion, sign up using The Wandering Investor’s referral form to save 10% on secure vault storage fees and unlock Tier-3 S.T.A.R. pricing from the start—typically reserved for clients purchasing 300 ounces of gold or 3,000 ounces of silver. Plus, the more you buy, the better your purchase prices get.

Get Premium Tier 3 S.T.A.R. pricing for FREE, plus discounts on metals purchases and storage fees.

Premium Tier 3 S.T.A.R. pricing for free

Discounts on metals purchases

Save 10% on storage fees

Secure Your Bullion

Use our contact form to learn more

Why store precious metals in Singapore with Silver Bullion?

Physical storage of precious metals requires not only a secure facility, but also a secure jurisdiction.

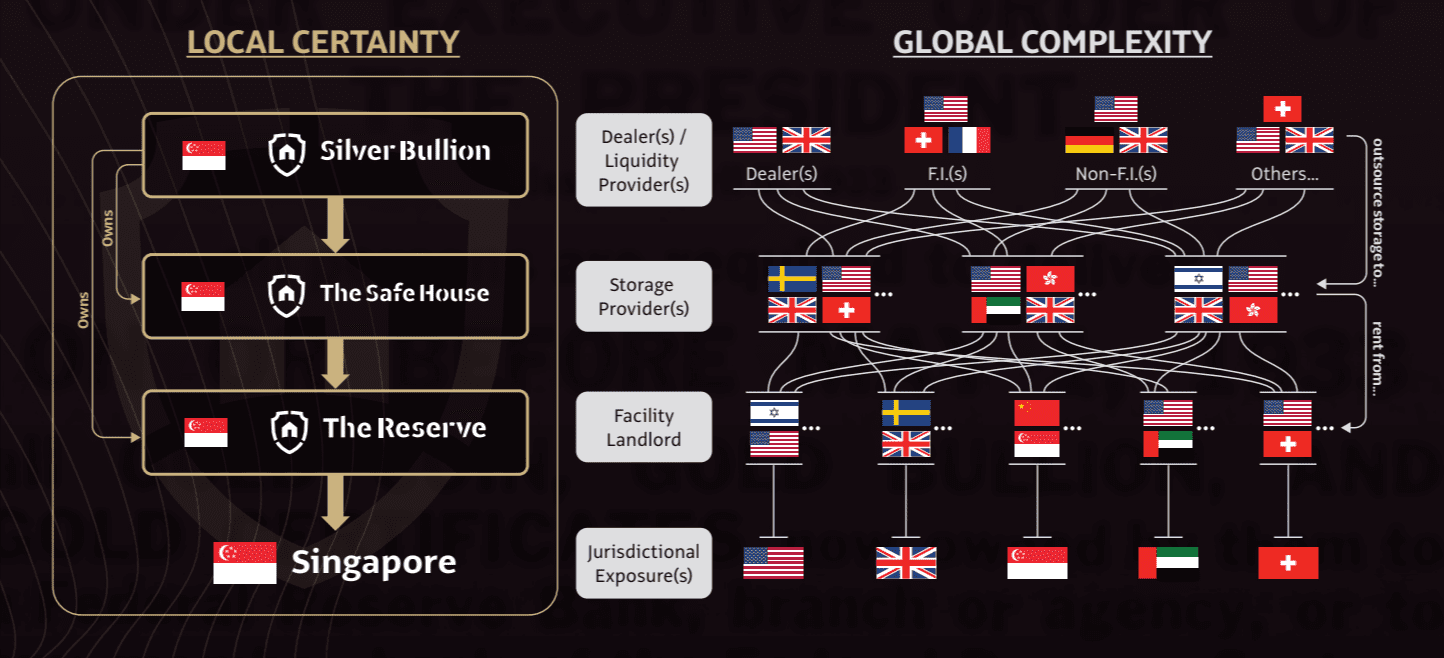

You should always ask yourself – how many companies are between you and your gold?

Each will carry its own jurisdictional and counterparty risk. Silver Bullion’s founders wanted to remove the layers between their clients and their metals. By dealing with a fully vertically integrated brokerage and vaulting company that is entirely Singaporean, you are dealing strictly with Singaporean entities and courts in the case of any effort to confiscate or nationalize your precious metal portfolio.

And being that Singapore is a geopolitically neutral country with highly developed national defenses, storing your metals here can reduce the risk profile of your gold and silver investments.

Enjoy flexible purchasing options with affordable spreads and competitive storage fees

You can purchase gold and silver remotely in virtually any quantity. Even fractional purchases of individual bars are allowed using the S.T.A.R. Grams program, and you are given unique identifying information about your bar.

This allows investors to accumulate through recurring monthly purchases of as little as $200, all while still retaining unique ownership of physical gold and silver. Your purchases can be publicly audited at any time using their real-time tracker.

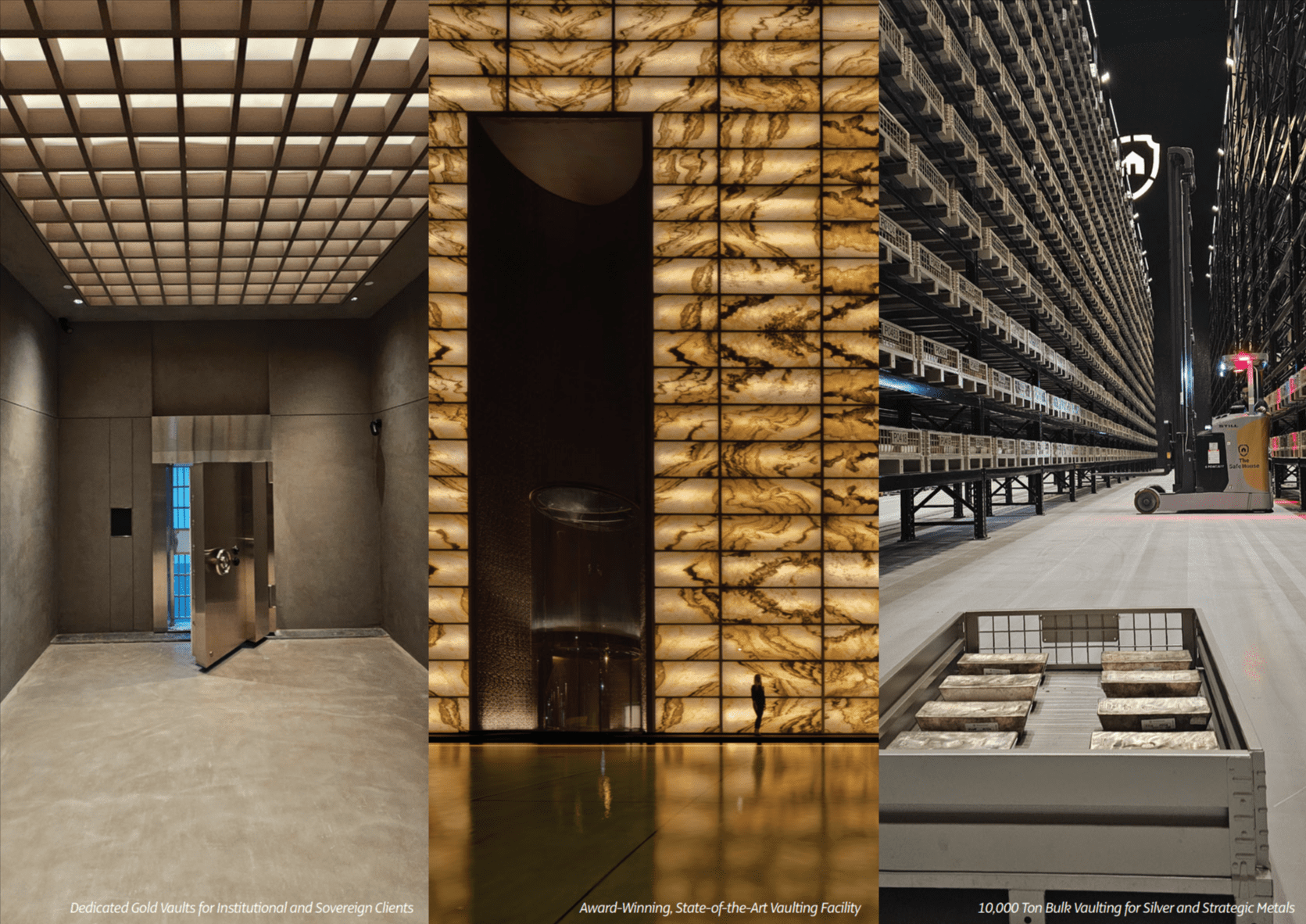

Silver Bullion offers a particular advantage for physical silver investors as they have the highest capacity, secure private silver vault in the world.

The economies of scale mean that they can offer competitive storage rates: between 70-50 basis points annually for physical silver depending on the quantity stored.

Gold storage rates are between 35-25 basis points annually, depending on volume.

Purchase prices for gold are approximately 2% over spot, and 4% over spot for silver.

Collateralized lending options

Silver Bullion can arrange peer-to-peer loans against your metals holdings at the vault. Interest rates are competitive, and you can borrow up to 60-65% of your portfolio.

Be reasonable

"Great team. Awe-inspiring facilities. Visionary leader. That all makes for one of the finest options in the world for buying and storing precious metals."

James Colyn

Contact Silver Bullion via The Wandering Investor for Discounted Storage and Free Premium Tier-3 S.T.A.R. Pricing

Secure your Gold & Silver with this exclusive offer only available using The Wandering Investor’s referral form.