12 MISTAKES TO AVOID WHEN INVESTING IN INTERNATIONAL REAL ESTATE

Navigate The International Markets

Gain On-the-Ground Insight and Overcome Uncertainty with Informed Decisions

Top Articles

Latest Articles

Capitalist Exploits: Investing in an age of Conflict

BREAKING NEWS: Caribbean Citizenship by Investment big price increases

San Juan Del Sur Real Estate Market: 2024 Investor’s Guide, Economic Trends in Nicaragua and Intriguing Case Studies

Pros and Cons of living in Medellin, Colombia

We bought a house in Playa del Carmen, Mexico!

Now is the time to pull the trigger on Egyptian Citizenship

International Real Estate Investments

San Juan Del Sur Real Estate Market: 2024 Investor’s Guide, Economic Trends in Nicaragua and Intriguing Case Studies

Making a Real Estate Investment in Medellin, Colombia – Unusually High Yields

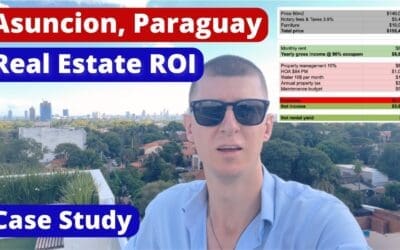

Asuncion Real Estate Market: Comprehensive Investor’s Guide 2024

Ultimate Guide to El Salvador Real Estate Market: 5 Positive Economic Trends, Insights & Analyses

Budapest Real Estate Market: 2024 Investor’s Guide

Full Guide: Puerto Vallarta Real Estate Market

Residency & Citizenship By Investment

BREAKING NEWS: Caribbean Citizenship by Investment big price increases

Easy: How to get Residency in Mexico

How to get Residency in Nicaragua – with my lawyer Eduardo

Turkey Citizenship by Investment – Timelines, Fees, and Traps to Avoid

Sark Island – a secret low-tax haven in Europe

Turkish Citizenship Bank Deposit option – Central Bank guarantee explained

Internationalization Insights

Updates from the Private List about international banking, on-the-ground international real estate case studies, alternative investments, international company formation and international economics.

Capitalist Exploits: Investing in an age of Conflict

Pros and Cons of living in Medellin, Colombia

We bought a house in Playa del Carmen, Mexico!

Now is the time to pull the trigger on Egyptian Citizenship

The New Administrative Capital of Egypt. Why, What, and how?

Investing in Asuncion Real Estate in Paraguay – an ROI case study with numbers

Explore a World of Opportunities with The Wandering Investor.

Embark on a Journey with Ladislas Maurice: Uncover Real Estate Investment Opportunities in Emerging Markets and Unlock the Benefits of Second Residencies and Citizenships.

Subscribe to my free Private List to get started:

Private Consultation

Internationalization and Diversification

Private, one-on-one consultation to answer your questions and to develop a custom internationalization and investment strategy.